COVID-19 Relief for Healthcare Providers: Key Insights on Programs and Compliance

The term “healthcare worker” has generally become synonymous with “hero” since the start of the pandemic. To keep those heroes ready and able to provide essential functions on the front lines, healthcare providers have turned to a number of federal and state COVID-19 relief programs and legislative provisions along the way. I am looking at some key insights and compliance considerations for recipients of select COVID-19 relief programs so they can continue their efforts.

Provider Relief Fund

The Provider Relief Fund (PRF) was established to help providers who diagnose, test, or care for patients with a possible or actual COVID-19 diagnosis and have healthcare-related expenses and lost revenues attributable to COVID-19. The U.S. Department of Health and Human Services (HHS) has distributed three general phases of relief to help eligible healthcare providers and provided targeted relief to high-need and vulnerable populations, such as nursing homes, skilled-care facilities, and providers in rural areas.

At present, there is $24 billion in funds remaining in PRF, and HHS says they will determine the usage at a later date. The HRSA is also making an $8.5 billion in American Rescue Plan Act (ARPA) funds available to qualified providers serving patients in rural communities. HRSA will post updates as these remaining resources become available.

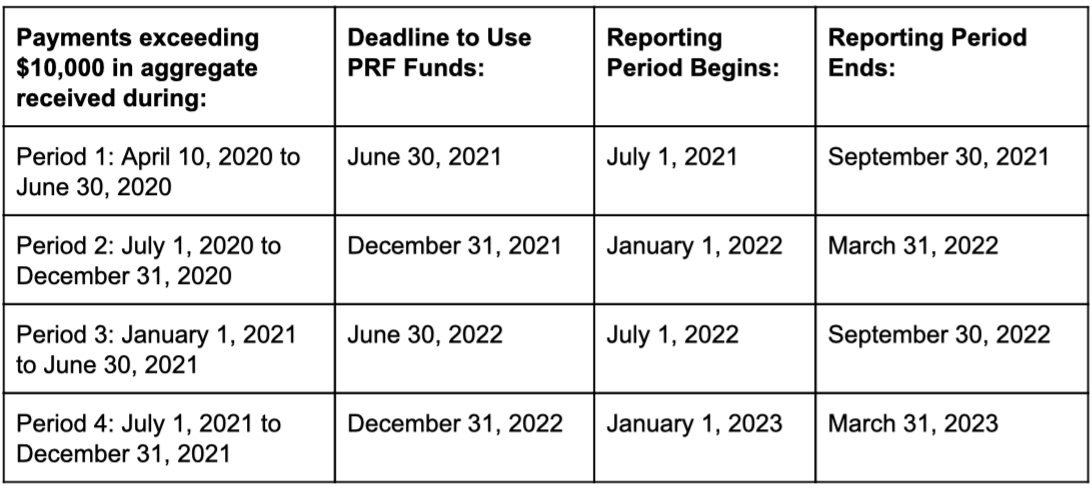

If your organization received payments exceeding $10,000 in aggregate during any of the four program-specified payment periods, you are required to register through the PRF Reporting Portal in order to carry out the reporting requirements.

The HRSA’s dedicated webpage also provides FAQ on reporting and auditing and other reporting resources.

COVID-19 Accelerated or Advance Payment Program

The Centers for Medicare & Medicaid Services (CMS) issued payments through the COVID-19 Accelerated or Advance Payment (CAAP) Program to help affected healthcare providers accelerate cash flow and ease financial strain due to COVID-19-related disruptions in claims submission and claims processing.

For some providers, CMS began the automatic recoupment process as early as March 30, 2021. The timing depends on the date of payment issuance, with automatic repayment beginning one year after issuance. After repayment begins, and for a period of 11 months, repayment will occur through an automatic recoupment of 25% of Medicare payments otherwise owed to you. For the subsequent six months, automatic recoupment increases to 50%. If, within 29 months, you cannot repay the total amount through recoupment, you will receive a demand letter from CMS requiring repayment of any outstanding balance, which is subject to 4% interest. However, you may request an Extended Repayment Schedule (ERS) through CMS if you are experiencing financial hardship.

Recipients should track the claims submitted, Medicare reimbursement received, and Medicare reimbursements recouped closely to help with reconciling the payments recouped toward your CAAP receivable. Additional information may be found on CMS’s CAAP Payment Fact Sheet and FAQ document.

Employee Retention Credit

The Employee Retention Credit (ERC) is a refundable tax credit available to eligible employers to claim against qualified wages, including approved costs for healthcare benefits paid while operations were shut down or restricted by a federal, state, or local governmental order or mandate related to COVID-19. Because the healthcare sector was deemed essential, several questions have arisen related to eligibility for healthcare providers.

The IRS addresses some of these questions in their updated program FAQ. A healthcare provider “may be considered to have a partial suspension of operations if, under the facts and circumstances, more than a nominal portion of its business operations are suspended by a governmental order” or if an order required the organization to close for a period during normal working hours.

Although a hospital’s ER would have remained operational, other departments, such as those performing elective procedures, likely did not. Even if an area is essential, a government order may have required a daily shut down in that area for cleaning. If your organization also employs non-essential workers to carry out business operations that were restricted or suspended by a governmental order, that may constitute a partial suspension, even if your essential operations were not affected.

Currently, the ERC applies to qualified wages paid from March 12, 2020 through December 31, 2021. However, if the Infrastructure Bill is accepted and passed as-is, the ERC tax credit will end on October 1, 2021.

Reimbursements for COVID-19 Vaccine Administration

Under CDC COVID-19 Vaccination Program regulations, participating organizations agree to administer the vaccine with no out-of-pocket patient cost and regardless of insurance coverage or network status. Through the HRSA COVID-19 Uninsured Program and the HRSA COVID-19 Coverage Assistance Fund, providers can request reimbursements for vaccines administered to uninsured and certain underinsured individuals.

Medicare-enrolled providers administering COVID-19 vaccinations are eligible for Medicare reimbursements of approximately $40 per single dose for vaccines administered on or after March 15, 2021, and approximately $40 per additional dose administered on or after August 12, 2021. For COVID-19 vaccines administered before March 15, 2021, providers can receive reimbursements of $28.39 for single-dose vaccines. For multiple doses, the reimbursement is $16.94 for the initial dose(s) and $28.39 for the final dose in the series.

Increased Medicare Inpatient Reimbursements

Under the CARES Act, Medicare increased the inpatient prospective payment system (IPPS) diagnosis-related group (DRG) rate during the public health emergency by 20% for COVID-19 patients. This relief measure was recently renewed through October 17, 2021. Compliance is key, so hospitals should be mindful of the documentation requirements associated with this increase. Audits by CMS and the Office of Inspector General (OIG) for the Department of Health and Human Services are on the horizon.

Contact Livingston & Haynes

My team at L&H is made of healthcare industry leaders who help healthcare providers leverage industry best practices, develop strategies that focus on every aspect of clinical and billing operations, and navigate evolving legislation. If you have questions about these COVID-19 relief programs, contact me today.

Maria Bunker, CPA, became a partner at L&H in 2017. Her specialties include audits and tax planning for a diverse range of industries, including healthcare providers, financial services, real estate partnerships, and various nonprofit organizations.